What to Know About Medicare Drug Benefit Enrollment

How Medicare Manages Many LTC Residents

It’s annual enrollment season for Medicare and this is a refresher for some of you. For others this may be news. The subject is how Medicare enrolls Medicaid/Medicare dual eligible beneficiaries and how that affects the residents you serve. This topic is relevant because the majority of long-stay nursing home residents are dually-eligible for Medicare and Medicaid.

Dual-Eligibles are Special

By definition, those who are dually eligible are not required to pay Medicare Part B premiums or cost-sharing. However, Medicare drug coverage is not mandatory, but optional. If dual-eligible beneficiaries are not enrolled in Medicare Part D, or get coverage through a Medicare Advantage plan, they will incur expenses that would otherwise be covered. CMS faced this issue early on in the Medicare Part D rollout and came up with a solution that is largely still in place today.

Automatic Enrollment

Consider the situation where a full-benefit Medicaid recipient (who receives Medicaid benefits without any cost sharing) becomes eligible for Medicare. Upon enrollment in Medicare, drug benefits are no longer covered by Medicaid. Because the Medicare drug benefit is voluntary, the government can’t force the beneficiary to enroll in Medicare Part D. The beneficiary is a dual-eligible, but doesn’t have a drug benefit if he/she fails to enroll. Failure to enroll may happen because the beneficiary is unable to choose a plan (e.g., they may have cognitive impairment that makes it impossible), or simply chooses not to.

Under these circumstances CMS automatically enrolls the beneficiary in a qualified Part D plan. This is referred to as “auto-enrollment”. The beneficiary has Medicare drug coverage and, as a dual-eligible, is not required to pay a Part D premium or participate in cost sharing.

Which PDPs are Qualified to Accept Auto-Enrollment?

Part D auto-enrollees will be enrolled only in plans that provide basic coverage, have premium that is at or below the low-income subsidy amount for their region, and other relevant requirements. These plans are identified in the landscape files with an “x” in column “G”. (Download landscape files)

Qualified PDPs must accept all beneficiaries assigned to them by CMS, included those who had been previously involuntarily disenrolled by the plan.

How CMS assigns beneficiaries to PDPs

States continuously send files to CMS to identify beneficiaries who qualify for dual eligible benefits. If the beneficiary doesn’t elect a PDP, CMS assigns the new dual-eligible to a PDP by the following process:

- CMS identifies qualified PDP sponsors in the region in which the beneficiary resides. If a sponsor has more than one qualified plan the first assignment is to the sponsor. All plans receive auto-enrollments at the sponsor level first. This is done by a random process and is intended to distribute enrollees evenly across all plans.

- If a sponsor has more than one PDP in the region, the next step assigns beneficiaries evenly across all the qualified plans of the parent sponsor.

- CMS calculates the effective date of enrollment as the first day of the second month after the current month.

- If the beneficiary is currently a Medicaid enrollee, the effective date of enrollment is the first day of Medicare Part D eligibility.

This example is from CMS Manual:

An individual has Medicaid coverage throughout 2010. On March 15, 2010, the State sends data identifying the person as a prospective full dual, who will become Medicare Part D eligible in May 2010. That night, CMS randomly auto-enrolls the person into a qualifying PDP effective May 1, 2010. The last day of eligibility for Medicaid prescription drug coverage is April 30, 2010.

The subject of Medicare Part D enrollment is a bit technical and complicated, but the main thing for LTC pharmacies to understand is that each calendar year will bring changes based on which PDPs are qualified to accept auto-enrollments. The list changes each calendar year and the result affects how currently auto-enrolled beneficiaries are assigned in the next calendar year.

How Auto-enrolled Beneficiaries are Assigned in Subsequent Years

Each new plan year brings a new assortment of Qualified PDPs for auto-enrollment. Plans that were included in the current- plan year may not be qualified for the following year. This may be due to the sponsor discontinuing the plan, or an increase in premium that places the plan outside the benchmark. In this case, if the beneficiary hasn’t chosen a different plan, CMS assigns them to a new qualified plan.

An exception to this is when the current plan’s new premium is a de minimis increase over the benchmark. In 2024 the de minimis increase is $2 or less. If the plan agrees to waive the de minimis amount and not charge the beneficiary the difference, its enrollees will not be reassigned. However, CMS will not assign newly-eligible beneficiaries to de minimis plans in the following year.

For beneficiaries assigned to a non-renewed plan, CMS will attempt to enroll them in a plan from the same sponsor. If no such plan is available, CMS will auto-assign them to another qualified plan operating in their region.

LINET

Another safety net created by CMS is the Low-Income Newly Eligible Transition (LINET). Since Part D benefits cannot be assigned retroactively, if the beneficiary is no longer qualified for Medicaid CMS will assign them to the LINET. Humana operates the LINET program and here is the link to Humana’s webpage that explains how the program works.

The auto-enrollment and facilitated enrollment process, as well as the Limited Income Newly Eligible Transition (LI NET) program are fairly complicated. If you are not familiar with these, please review the relevant section of the CMS Prescription Drug Benefit Manual, Chapter 3-Eligibility, Enrollment and Disenrollment. Also see the CMS document on LI NET

relevant section of the CMS PDP Enrollment Guidance. Also see the CMS document on LI NET

Free Subscription to LTC Pharmacy News

Additional Resources

Interested in learning more about Medicare enrollment and how it works? Take a look at these resources.

To compare the PDPs eligible for auto-assignment in 2024 with those for 2023 please open this pdf and see the changes for each of the 34 CMS PDP Regions.

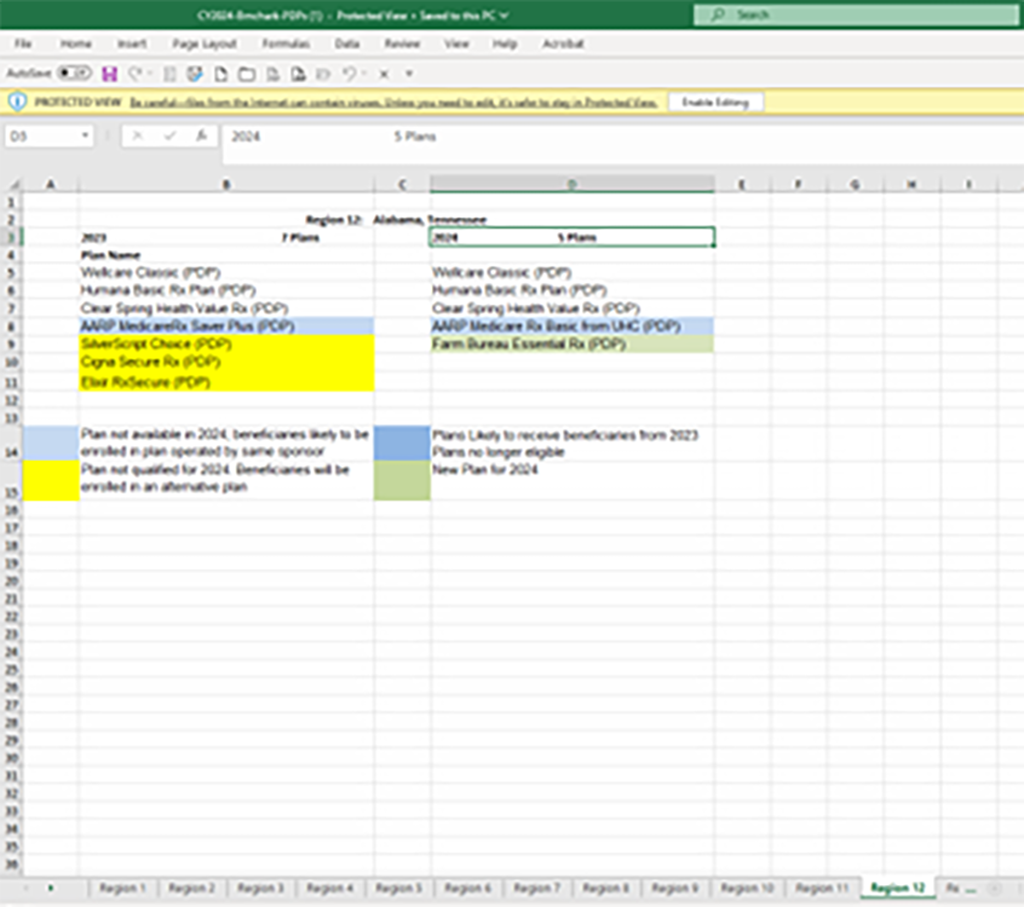

Above is a screenshot of the spreadsheet for Region 12 (Alabama and Tennessee). The left column lists the 2023 PDPs eligible for auto-assignment and the right column contains the names of the PDPs eligible for auto-assignment for 2024.

The cells marked with blue background on the left are the plans that won’t be eligible for auto-assignment in 2024 but have an eligible PDP from the same sponsor in 2024. The corresponding cell on the right with the blue background will receive beneficiaries auto-assigned to the affected cell on the left side.

The left column has cells with a yellow background. These are PDPs losing their auto-assignment status in 2024. Beneficiaries auto-assigned to these PDPs will be enrolled randomly in one of the plans listed on the right column.

Cells with green backgrounds in the right are newly-qualified auto-assignment plans for 2024.